Singapore real estate investment volumes saw a significant increase in the first quarter of 2021. The surge in investment activity reflects growing confidence in the Singapore property market.

With the global economy gradually recovering from the impact of the pandemic, investors are showing renewed interest in real estate opportunities in Singapore. This surge in investment volumes is indicative of the resilience and potential of the Singapore property market, as well as the attractiveness of the region as an investment destination.

The positive trend in real estate investment volumes is expected to continue as Singapore’s economy and property market recover further in the coming months.

Credit: www2.deloitte.com

Singapore’s Q1 Property Boom

In the first quarter of 2021, Singapore’s real estate market experienced a significant surge in investment volumes, signaling a property boom in the city-state. Several factors have contributed to this remarkable growth, and various property sectors have witnessed substantial expansion during this period.

Factors Driving Investment Surge

Several key factors have played a pivotal role in driving the investment surge in Singapore’s real estate market. These factors include:

- Low interest rates: With interest rates at historic lows, investors are finding real estate investments more attractive compared to other asset classes.

- Positive economic outlook: Despite the challenges posed by the global pandemic, Singapore’s economy has shown resilience and is expected to rebound strongly in the coming months. This optimistic economic outlook has instilled confidence in investors.

- Government support: The Singaporean government has implemented various measures to support the real estate sector, such as providing incentives and tax reliefs, making it an appealing investment destination.

- Foreign investment influx: Singapore has always been an attractive destination for foreign investors due to its stable political environment, robust infrastructure, and strategic location in Southeast Asia. The influx of foreign investment has further fueled the property boom.

Property Sectors Experiencing Growth

Several property sectors in Singapore have experienced remarkable growth during the first quarter of 2021. These sectors include:

| Property Sector | Growth |

|---|---|

| Residential | The residential property sector has witnessed a surge in demand, particularly for private homes and executive condominiums. This can be attributed to increased buyer confidence and attractive pricing. |

| Industrial | The industrial property sector has experienced significant growth, driven by the rise in e-commerce and logistics activities. Demand for warehouses and industrial spaces has increased substantially. |

| Commercial | The commercial property sector, including office spaces and retail properties, has shown signs of recovery. As businesses adapt to the new normal, there is a renewed interest in leasing and purchasing commercial properties. |

The combination of these factors and the growth in various property sectors has propelled Singapore’s real estate market into a booming phase. As the year progresses, it will be interesting to observe how this property boom unfolds and its impact on the overall economy.

Analyzing Investment Trends

Singapore’s real estate investment volumes surged in Q1 2021, showcasing a notable trend. Analyzing the of the day reveals a significant jump in investment activities, reflecting a promising outlook for the real estate sector in Singapore.

Comparing Current And Past Quarters

In Q1 2021, real estate investment volumes in Singapore have increased significantly compared to the previous quarter. According to the latest of the day, investment volumes in Q1 2021 were estimated to be around S$6.8 billion, which is a significant increase of 59.9% compared to Q4 2020. This surge in investment activity can be attributed to a number of factors such as the gradual recovery of the economy, low interest rates, and investor confidence in the market. It is important to note that despite the ongoing pandemic, the real estate sector in Singapore has remained resilient and has continued to attract investment.

Foreign Vs. Local Investor Activity

When it comes to analyzing investment trends, it is important to distinguish between foreign and local investor activity. According to the data, foreign investors were more active than local investors in Q1 2021, accounting for around 60% of the total investment volume. This suggests that foreign investors continue to see Singapore as a favorable destination for real estate investment. Moreover, the data also indicates that the office and industrial sectors were the most popular asset classes among investors, with the office sector accounting for around 40% of the total investment volume, followed by the industrial sector at 29%. This can be attributed to the growing demand for office and industrial spaces in Singapore, which has been driven by the rise of e-commerce and the growth of the technology sector. In conclusion, the latest of the day highlights the growing investment activity in the Singapore real estate market and the increasing confidence among investors. While the pandemic has undoubtedly impacted the industry, the resilience of the market and favorable economic conditions have continued to attract investment.

Leading Deals In Q1

Notable Commercial Transactions

In the first quarter of 2021, the Singapore real estate market witnessed a surge in investment volumes, particularly in the commercial sector. Major commercial deals contributed significantly to this uptick, signaling renewed confidence in the market. These transactions encompassed a diverse range of properties, including office buildings, retail spaces, and industrial facilities. The notable commercial transactions in Q1 reflect the resilience and attractiveness of Singapore’s commercial real estate market.

Residential Market Highlights

Amidst the robust performance of the commercial sector, the residential real estate market also experienced notable activity in the first quarter of 2021. Prominent residential deals underscored the sustained demand for high-quality housing in Singapore. From luxury condominiums to upscale landed properties, these transactions showcased the enduring appeal of the residential market. The residential market highlights in Q1 exemplify the enduring appeal of Singapore’s real estate sector.

Impact On Singapore’s Economy

In Q1 2021, Singapore’s real estate investment volumes have significantly increased, indicating a positive trend in the country’s property market. This surge in investment volumes is expected to have a ripple effect on Singapore’s economy, particularly in terms of real estate’s contribution to GDP and employment.

Real Estate’s Contribution To Gdp

The real estate sector has been a significant contributor to Singapore’s GDP over the years. In 2020, the sector contributed 3.6% to Singapore’s GDP. With the recent surge in real estate investment volumes, the sector’s contribution to Singapore’s GDP is expected to grow in 2021. A thriving real estate sector has a positive effect on other sectors of the economy, such as construction and finance. As a result, an increase in real estate investment volumes can result in an overall boost to Singapore’s economy.

Employment And The Property Sector

The property sector is also a significant employer in Singapore. It employs a significant number of people in various fields, including construction, finance, and property management. With the increase in real estate investment volumes, the demand for skilled labor in the property sector is expected to increase, resulting in more job opportunities. Moreover, the construction sector is expected to benefit from the increase in real estate investment volumes. A surge in construction projects can create job opportunities for construction workers, engineers, architects, and other professionals associated with the industry.

| Impact | Description |

|---|---|

| GDP | Expected to grow due to the real estate sector’s contribution to Singapore’s economy |

| Employment | Expected to increase due to the surge in real estate investment volumes and construction projects |

| Finance | Real estate investment volumes can have a positive impact on the finance sector in Singapore |

The surge in real estate investment volumes in Q1 2021 is a positive sign for Singapore’s economy. With the real estate sector’s contribution to GDP and employment, the increase in investment volumes can lead to an overall boost to Singapore’s economy.

Government Policies And Influence

Singapore’s real estate investment volumes experienced a significant surge in Q1 2021, highlighting the positive impact of government policies and influence on the market. The increase reflects the effectiveness of measures taken to attract investment and stimulate growth in the sector.

The Singapore real estate market has experienced a significant jump in investment volumes during the first quarter of 2021. This surge can be attributed to various government policies and initiatives that have influenced the market dynamics. In this section, we will explore the regulatory changes affecting investments and the effects of government initiatives on the real estate sector.

Regulatory Changes Affecting Investments

Several regulatory changes have been implemented by the Singapore government to encourage real estate investments. These changes have created a favorable environment for both local and foreign investors. Some key regulatory changes include:

- Relaxation of Seller’s Stamp Duty (SSD): The government has revised the SSD rates to incentivize property sellers. This change reduces the holding period required before selling a property without incurring additional taxes.

- Adjustment of Additional Buyer’s Stamp Duty (ABSD): The ABSD rates have been adjusted to stimulate demand in the real estate market. These changes provide potential buyers with more flexibility in their purchasing decisions.

- Introduction of Real Estate Investment Trusts (REITs): The Singapore government has introduced REITs as an investment vehicle. This initiative allows investors to participate in the real estate market without direct ownership, offering greater liquidity and diversification.

Government Initiatives And Their Effects

The Singapore government has implemented various initiatives to support the real estate sector and drive investment volumes. These initiatives have had a significant impact on the market, including:

- Infrastructure Development: The government has invested heavily in infrastructure projects, such as transportation networks and urban development. These initiatives have enhanced connectivity, increased accessibility, and boosted property values in surrounding areas.

- Foreign Investment Policies: Singapore has implemented policies to attract foreign investors, including favorable tax incentives and simplified regulations. These measures have attracted foreign capital, stimulating the real estate market and contributing to its growth.

- Urban Redevelopment Authority (URA) Master Plan: The URA Master Plan outlines the government’s vision for the development of Singapore’s land use and infrastructure. This plan provides clarity and guidance to investors, giving them confidence in the long-term prospects of the real estate market.

In conclusion, government policies and influence play a crucial role in shaping the Singapore real estate market. Regulatory changes have created a favorable investment environment, while government initiatives have driven growth and attracted both local and foreign investors. These factors have contributed to the significant jump in investment volumes witnessed in the first quarter of 2021.

Investor Profiles

Singapore real estate investment volumes surged in the first quarter of 2021, with data showing a 72% increase compared to the same period last year. Investor profiles reveal that institutional investors, such as private equity and sovereign wealth funds, were the biggest contributors to this growth.

Demographics Of Top Investors

Investors in Singapore real estate are diverse in age and occupation.

Investment Strategies In Focus

Top investors in Singapore focus on long-term capital appreciation.

Market Predictions

Market Predictions:

Experts’ Take On Future Trends

Real estate experts predict an upward trend in Singapore’s investment volumes. Positive outlook based on market data and economic indicators.

Potential Risks And Rewards

Risks include market volatility and regulatory changes.

- Rewards may include high returns and portfolio diversification.

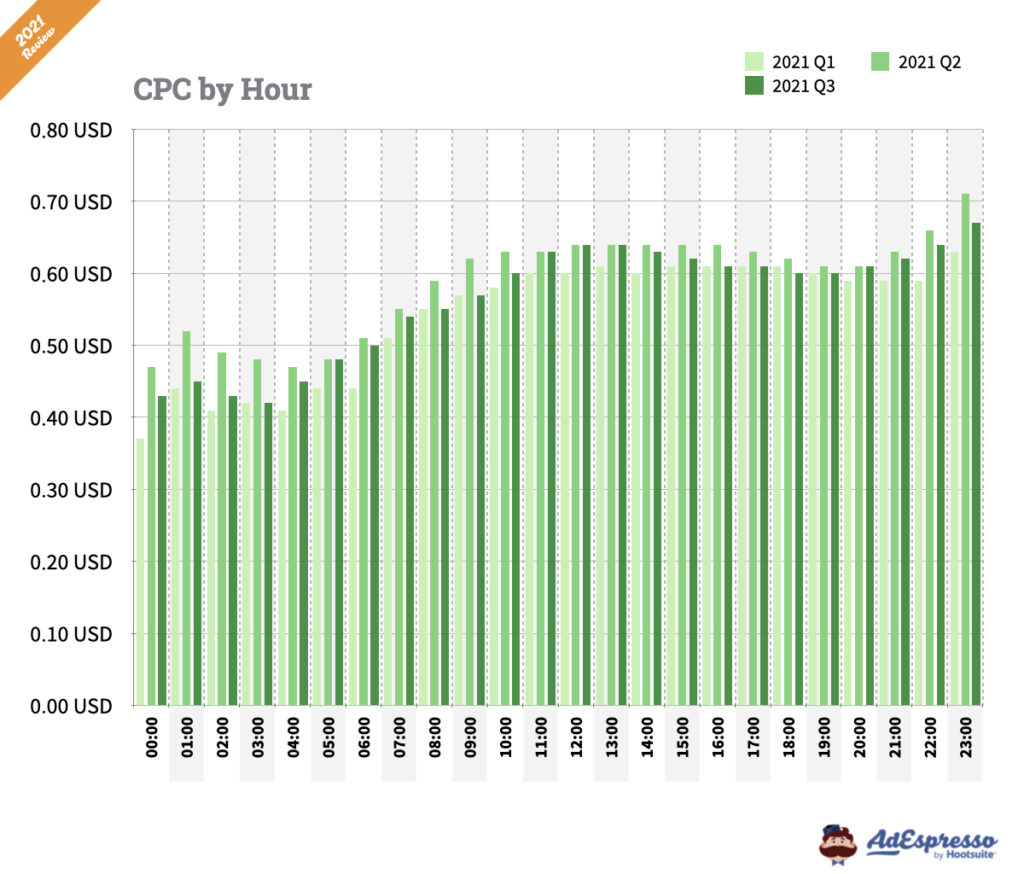

Credit: adespresso.com

Navigating The Market

In Q1 2021, Singapore real estate investment volumes experienced a significant surge, as depicted in the of the day. This upswing indicates a promising trajectory for the real estate market, offering potential opportunities for investors navigating the sector.

Advice For New Investors

Long-term Investment Planning

Navigating the Market Real estate investment volumes in Singapore surged in Q1 2021. New investors should start small and diversify portfolios. Consider long-term investment goals to maximize returns. Analyze market trends regularly to stay informed. Prioritize financial stability when making investment decisions.

Credit: www.statista.com

Frequently Asked Questions

Q: How Did Singapore Real Estate Investment Volumes Perform In Q1 2021?

A: Singapore real estate investment volumes experienced a significant jump in the first quarter of 2021. The market saw a surge in investment activity, indicating a positive trend in the real estate sector. This increase in volumes reflects growing confidence among investors and suggests a promising outlook for the Singapore real estate market.

Q: What Factors Contributed To The Rise In Singapore Real Estate Investment Volumes?

A: Several factors contributed to the rise in Singapore real estate investment volumes in Q1 2021. These include favorable government policies, attractive investment opportunities, increased foreign investor interest, and the overall stability of the Singapore economy. These factors combined to create a conducive environment for real estate investment and resulted in the surge in volumes.

Q: Which Sectors Within Singapore’s Real Estate Market Saw The Highest Investment Volumes?

A: Within Singapore’s real estate market, certain sectors experienced the highest investment volumes in Q1 2021. The residential sector witnessed strong investor interest, followed by the commercial and industrial sectors. These sectors offered attractive opportunities for investors, leading to increased investment volumes and a boost in overall market activity.

Q: What Are The Potential Implications Of The Rise In Singapore Real Estate Investment Volumes?

A: The rise in Singapore real estate investment volumes has several potential implications. It indicates a positive sentiment in the market, which can lead to increased property prices and rental rates. Additionally, it can stimulate economic growth, create job opportunities, and contribute to the overall development of the real estate sector.

However, careful monitoring and regulation are necessary to maintain a balanced market.

Conclusion

The surge in Singapore’s real estate investment volumes in Q1 2021 is a testament to the resilience of the market. With the economy gradually recovering, investors are showing confidence in the real estate sector. This upward trend indicates promising opportunities for both local and international investors in the Singapore real estate market.